In the wave of N-type technology innovation in photovoltaics, the TOPCon track has become increasingly crowded, while BC technology has seen fewer adopters. In contrast, heterojunction (HJT) technology appears to offer more growth potential and sustainable development opportunities.

Since the beginning of this year, HJT module shipments have been steadily rising, and more and more central state-owned enterprises (SOEs) are setting up independent HJT bidding sections. These signs suggest that HJT is quietly expanding its market share and industrial position.

What is even more noteworthy is that, in an increasingly homogenized and competitive industry, HJT has managed to maintain relatively rational pricing in project bids. The vitality of this new technology is gradually becoming apparent.

Recently, Energy magazine interviewed Gao Fei, General Manager of Grand Sunergy, to discuss the bottoming-out of the photovoltaic (PV) industry, the rise of HJT technology, and the primary paths for reducing costs.

Below is the transcript of the interview:

Energy: This year, the PV industry has experienced a period of overall market sluggishness. From your perspective, when do you think the PV industry will truly bottom out?

Gao Fei: A major characteristic of this year has been the brutal “price war.” Recently, we’ve seen bid prices for TOPCon modules drop below 0.7 yuan per watt. For any company, this price is far below the cost line, which runs counter to the basic requirements for stable business operations.

Many companies are quoting ever-lower prices, reflecting a rather pessimistic view of the current supply-demand relationship and short- to medium-term market demand. This continued low-price strategy poses a significant challenge to cash flow and capital reserves for each company. As for when the industry will truly bottom out, it’s hard to predict right now. Effective industry consolidation, macroeconomic guidance and regulation, and the cash flow on companies’ balance sheets are all influencing factors. But one thing is certain: unreasonable low-price competition is not the industry’s norm, and without an effective “blood supply” mechanism, this “price war” will inevitably lead to cash flow exhaustion for companies.

Energy: The intense competition has also led to a continuous drop in the prices of PV products. Based on Grand Sunergy’s observations, what factors are the most sensitive to owners and investors in the current PV market? Does the lower pricing have any positive effects on industry development?

Gao Fei: Cost-effectiveness has always been a crucial factor for owners and investors, and it’s an essential guarantee for better investment returns. However, we must recognize that low prices don’t naturally equate to better cost-effectiveness.

From the perspective of developers or investors, overly low prices will inevitably bring significant challenges to quality control. Sacrificing quality for lower prices is clearly not what investors are aiming for, nor should it be the development direction of the entire industry. On the other hand, investors, especially central SOEs, seek more stable cost reductions rather than drastic price cuts.

After a rapid price drop, there is a strong likelihood that prices could rise sharply again. From the perspective of investment stability and project progression, this is not a reasonable expectation.

For companies, healthy business operations have also become a key focus for many investors, particularly overseas clients. At this stage, the “30-year” warranty on a company’s development is even more critical than a “30-year” product performance guarantee.

The PV industry has always been driven by technology advancements, and the continued price drop is an inevitable outcome of technical iterations.

However, a “suicidal” price decline will lead the market to become purely price-driven, dragging the entire industry into a prolonged price war. To ensure that lower prices have a positive impact on the industry, we need to find a balance between stimulating market growth and maintaining reasonable profitability.

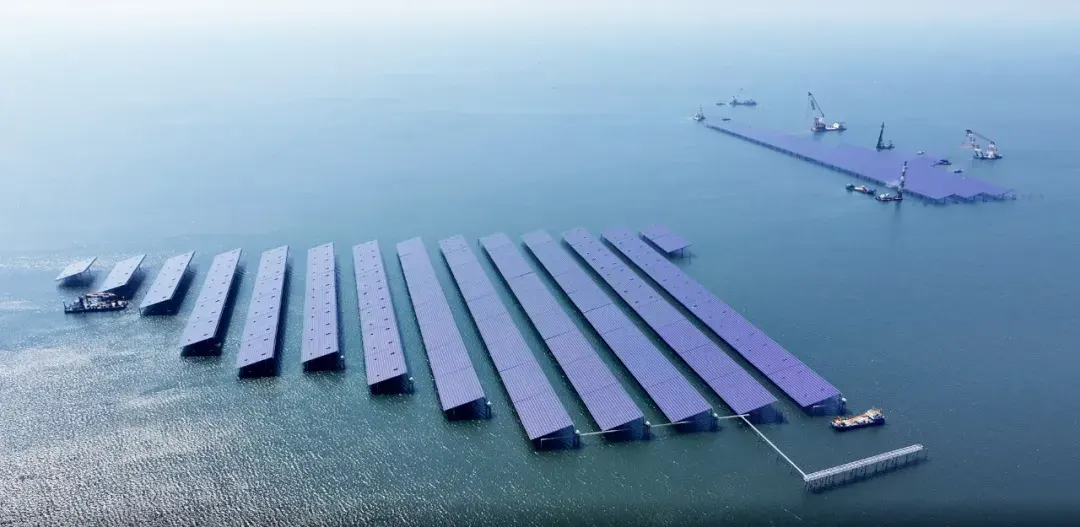

Yantai Zhaoyuan 400MW Offshore PV Project

Energy: As PV module prices continue to fall, HJT modules have consistently maintained a certain premium. How is this achieved?

Gao Fei: Currently, there aren’t many companies focusing on HJT as their main direction for R&D, investment, and manufacturing, and most of them are new players in the PV industry. These HJT companies are acutely aware of the importance and urgency of maintaining the HJT pathway and ensuring their own healthy development in an increasingly competitive environment. On September 6, the sixth roundtable meeting of the 740W+ High-Efficiency HJT Club was held in Shanghai. Since its inception, this club has served as an essential platform for HJT companies to maintain communication and coordination. It not only fosters technological exchange and supply chain cooperation but also serves as the main window for HJT companies to collaborate on the future direction of the industry. Through effective communication, the club has established a balance between competition and cooperation.

In terms of the HJT industry, last year’s HJT module tenders were around 1GW, while this year, the tender volume is expected to exceed 10GW. The rapidly expanding market size provides fair competition opportunities for each HJT company. From a technical standpoint, HJT products offer advantages in efficiency and performance over other technological pathways, allowing for some premium pricing in the market. Additionally, fully leveraging HJT’s technical strengths in specific PV application scenarios, such as offshore photovoltaics, where demand has grown rapidly in recent years, can also enhance premium potential.

However, we must also be clear about the urgency of reducing costs and improving efficiency for HJT. If the technical advantages are insufficient to support a reasonable premium, uncertainties will inevitably arise in HJT’s development. Currently, HJT technology is steadily reducing costs, and achieving manufacturing costs on par with TOPCon products is our firm short-term goal.

Energy: What are the main pathways for reducing HJT costs?

Gao Fei: HJT has advantages in process flow, efficiency, and materials.

In terms of the process, HJT requires only four steps: cleaning and texturing, amorphous silicon film deposition, TCO film deposition, and screen printing. This helps improve production yields and reduces labor and operational costs for cell factories.

HJT’s low-temperature manufacturing characteristics allow the use of specially designed silicon materials and ultra-thin wafers, significantly reducing silicon costs. The mainstream HJT cell wafer thickness is currently 110μm, thinner than TOPCon’s 125μm. We expect to introduce 90μm wafers starting in Q4 this year, with full-scale production next year.

Additionally, with the gradual maturity of technologies such as 0BB (busbar-free), silver-coated copper, and copper electroplating, there’s still significant room for HJT cost reduction. This is why we believe HJT can achieve cost parity with TOPCon.

Furthermore, as the HJT industry scale continues to expand, equipment and raw material costs will also decrease. These factors combined give us reason to believe that HJT will become the mainstream technology in the PV industry in the future.

Laizhou Tushan 600MW Salt and PV Complementary Project

Energy: The competitiveness of HJT products is steadily increasing. Will we see a rapid increase in HJT capacity in the short term?

Gao Fei: In the short term, rapid growth in HJT capacity may be difficult to achieve due to constraints such as talent and capital.

HJT follows a semiconductor technology pathway, which differs significantly from traditional crystalline silicon cells in production. This requires specialized talent for R&D and manufacturing, and there is currently a talent shortage in the HJT industry.

Another major limitation is the current turbulence in the industry. The PV industry is currently at the bottom of its cycle, and both the capital market and financial institutions have been extremely cautious about financing PV companies. Therefore, HJT capacity expansion is unlikely to occur as quickly as PERC and TOPCon did.

However, I don’t see this as bad news. Currently, demand for HJT from TOPCon owners and investors is significantly increasing. Due to capacity limitations, HJT supply will not fluctuate much in the short term, which could result in a supply shortage.

Stable pricing will motivate companies to invest in technological advancements and cost reductions while avoiding the negative effects of overcrowding.